Black Friday is coming up and with that, the rebate wars begin like every other year. For many ecommerce shops, this may lead to a suicidal backfire as the environment has changed drastically since last Black Friday. In general, it seems like the only remaining instrument to stimulate the consumers’ need for new fashion is price wars (Kolf, 2019) (IFH Köln, 2022). In the long run, this is highly unprofitable and leads to a swirl of decreased prices, which is increasingly hard to get out of. Rebates are a signal for customers to expect more rebates and lower prices in the future. These expectations lead to customer patterns that are unfavorable for online retailers. In low-interest rate environments, the primary goal for most has been revenue growth, and the problems of a swirl of rebates are not salient for the retailers. However, as online stores face increasing interest rates and full stocks, the primary goal is no longer revenue growth but a growth that is healthy and sustainable. The new reality is painful for most since COVID-19 seemed to be a sustainable booster for the whole sector but backfired as the demand is saturated and people prefer to spend their money on experiences (IBISWorld, 2022). On top of that, many households must save money to compensate for expenses such as high energy costs and inflation in general (IFH Köln, 2022).

The biggest problem for the whole fashion industry is the state of their stocks: shelfs are bending and fewer people seem to be willing to buy (Behn, 2022), even though prices in the fashion industry do not rise as fast as in other sectors (Statista, 2022). Theoretically, it should lead to increased sales in ecommerce, as the prices are relatively lower, yet the whole industry declines (Salesforce, 2022). Usually, Black Friday is meant to boost the sector before Christmas shopping. This year, customers appear to be less impulsive (IFH Köln, 2022) and thus, this may lead to a weak Black Friday. Generally, the question arises whether customers who are more certain about their purchase decision are supposed to be shown a coupon to further be incentivized. On the other hand, a coupon may be a great incentive for customers who are less certain about their purchase decision. If the certainty about the purchase decision is predictable, intelligent couponing may be one possible solution.

We analyzed more than 100,000 orders from a big German online fashion retailer that were divided into a control group and two treatment groups, one with static coupons and one with intelligent, personalized coupons. The static coupon group contained online shoppers, who got displayed a discount code on the landing page of the shop (for example, “Get 20% off today with this code “Sales22”). The second treatment group got displayed a discount code intelligently in their cart. The control group contained online shoppers with the same behavior patterns as the two treatment groups but did not receive anything.

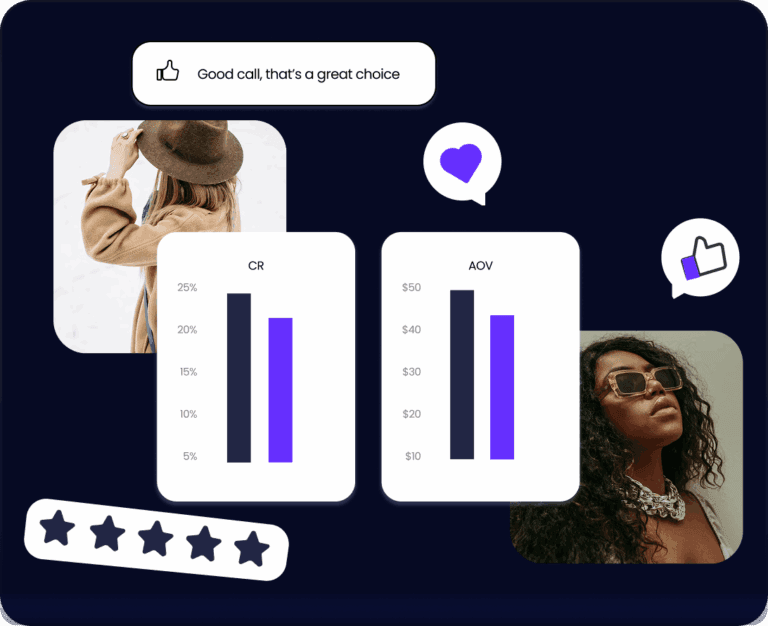

Static coupons:

What is intelligent couponing? We segmented customers into those who are likely to buy and those who are likely to abandon their carts. The ones who were likely to buy did not receive a coupon, while the ones who were likely to abandon their cart received a coupon. How does this work? The segmentation must happen before the buying decision is made by the customer i.e., the buying decision has to be predicted. Based on large-scale clickstream and behavioral data, the behamics AI platform predicts the purchase probability and even the exact situation of a cart abandonment of thousands of online shoppers with more than 95% accuracy. Based on these behavior predictions, the coupons were displayed dynamically in the cart.

Intelligent coupons:

The results show that:

- Static coupons increase product returns by 8% and decrease net revenues by 10%.

- Intelligent coupons decrease product returns by 4% and increase net revenues by 30%.

- The results are statistically significant on a 99% level.

How can these results be explained behaviorally? It seems odd that uncertain customers are found to have a lower return rate than those customers who were certain about buying. Behavioral science delivers possible explanations for that phenomenon.

First, the cognitive dissonance can be reduced by a lower price. Cognitive dissonances describe a mismatch between customers’ beliefs and behavior which means that people feel discomfort when their behavior does not align with their values or beliefs (Festinger, 1962). A reduced price can reduce these feelings of discomfort. The effect can be especially strong if the coupon is handed out in the cart because the customers are already committed to the selected products. After the purchase, they might also remember that they made a good deal which reduces dissonances, and consequently also returns.

Second, reciprocity – which describes the tendency to return favors – may lead to positively intended behavior by the customers (Fehr & Gächter, 2000). They may perceive the coupon as a favor since they received it unexpectedly in their cart. The human tendency to return favors can lower their return intentions. Third, static upfront couponing incentivizes unthoughtful shopping behavior (Gabler & Reynolds, 2014). The upfront static couponing increases scarcity that the sale ends soon which leads to irrational and unthoughtful shopping behavior – increasing product returns. The upfront coupon sets a low reference price, and a scarcity of higher future prices comes into play.

On the other side, an important part of coupons is the additional traffic that is reached through them. It cannot be denied that this traffic can have a significant additional value. In the end, the extra traffic stands against multiple costs: the costs of lost revenue due to customers who would have also bought without a coupon, the costs due to higher return rates, and the costs of training the customers to wait for rebates. Those costs combined must be considered and determined individually. If those costs exceed the value through traffic, the upfront coupon strategy must be revised. The money could be spent on other marketing instruments that promote a long-term customer relationship.

All in all, the price war swirl downwards can be toxic for online retailers and static couponing reinforces this problem. Intelligent couponing can be a solution to still incentivize uncertain customers to buy while not deteriorating brand value and long-term perception. This results in increased revenues and even decreased product returns which improve the net revenue. The need of building a healthy relationship has never been as important as in the current economic environment and, thus, should be invested in!

References:

- Behn, H. (2022, September 15). Peak-Saison: Das sollten Händler jetzt bei der Warenbeschaffung beachten. Onlinehändler-News. Retrieved November 16, 2022, from https://www.onlinehaendler-news.de/online-handel/praxistipps/136955-peak-saison-haendler-warenbeschaffung-beachten

- Fehr, E., & Gächter, S. (2000). Fairness and Retaliation: The Economics of Reciprocity. JOURNAL OF ECONOMIC PERSPECTIVES, 14(3), 159 – 181. https://www.aeaweb.org/articles?id=10.1257/jep.14.3.159

- Festinger, L. (1962, October). Cognitive Dissonance. Scientific American, 207(4), 93 – 106. https://www.jstor.org/stable/24936719

- Gabler, C. B., & Reynolds, K. E. (2014, December 08). Buy Now or Buy Later: The Effects of Scarcity and Discounts on Purchase Decisions. Journal of Marketing Theory and Practice, 21(4), 441 – 456. https://www.tandfonline.com/doi/abs/10.2753/MTP1069-6679210407?casa_token=yuyEPMg29gEAAAAA:WgiccEldXpGufUghTRLw3gPsoaj7Ex67vmS4owGvHJjrYpCB7A8ahSWduCvD4AorynuivvLXNVsr3A

- IBISWorld. (2022, June 14). Konsumausgaben für Freizeitaktivitäten, Kultur und Unterhaltung – Deutschland. IBISWorld. Retrieved November 17, 2022, from https://www.ibisworld.com/de/bed/konsumausgaben-fuer-freizeitaktivitaeten-kultur-unterhaltung/502/

- IFH Köln. (2022, 11 15). Trend Check Handel. IFH Köln. Retrieved November 15, 2022, from https://www.ifhkoeln.de/teilen/trend-check-handel/

- Kolf, F. (2019, November 27). Shoppingevent: So gefährlich sind für Händler pauschale Rabatte am Black Friday. Handelsblatt. https://www.handelsblatt.com/unternehmen/handel-konsumgueter/shoppingevent-so-gefaehrlich-sind-fuer-haendler-pauschale-rabatte-am-black-friday/25276426.html

- Salesforce. (2022, October). The Shopping Index. Salesforce. Retrieved November 16, 2022, from http://salesforce.com/resources/research-reports/shopping-index/

- Statista. (2022, November). Inflation – Preissteigerung nach Produkten im Oktober 2022. Statista. Retrieved November 15, 2022, from https://de.statista.com/statistik/daten/studie/1048/umfrage/preissteigerung-fuer-ausgewaehlte-waren-und-dienstleistungen/